What is a commercial lease?

by Admin

Posted on 19-07-2022 10:32 AM

Commercial Real Estate (CRE)

Sydney commercial properties for sale

sydney

commercial real estate agents

sydney sold commercial properties.

Fitzpatricks commercial is the result of fitzpatricks real estate merging forces with pci commercial, two of wagga wagga’s most iconic real estate brands. Fitzpatricks commercial has the largest commercial property management portfolio in the city. In the 2020-2021 financial year the office sold $27,057,220 worth of commercial property and over $100 million in the past 9 years – more than any other local commercial property agent. We have seven staff available with the key principals having over 83 year’s experience in the field of business and property management. Our success has been due to our comprehensive knowledge and commitment to the wagga wagga market.

An end-to-end service for commercial landlords and tenants backed by a network of 600 savills offices around the world, we receive constantly-updated market intelligence, which helps us reach the right potential occupiers at the right time. Similarly, when representing those seeking commercial real estate, we know what is available to lease, often before it is officially available. As a result, our clients gain access to the most comprehensive commercial property leasing service available.

Bawdens’ focus on the sydney market extends from lane cove right through to campbelltown and all the major commercial and industrial areas in between. Bawdens’ portfolio includes suburbs that are centrally located and possess the potential to contribute to any business. In south western sydney these include fairfield, smithfield and wetherill park, where industrial sites and warehouses are prominent. Commercial and industrial real e state in the northwest region include expansive office and retail space, established in castle hill, baulkham hills and seven hills. Bawdens are also committed to commercial and industrial properties in suburbs such as homebush, rydalmere, auburn, gladesville, yennora, lidcombe and huntingwood.

Copied the racial homeownership gap has received considerable attention, and rightly so: at 42%, the black homeownership rate is about 30 percentage points lower than that of whites. However, the gap in commercial-property ownership is just as disturbing. Only 3% of black households own commercial real estate, compared with 8% of white households, and their holdings are much smaller — valued at just $3,600 on average, compared with nearly $34,000 for white households. These alarming findings come from a brookings institution report on race and commercial real estate we released this week, part of a large r series examining wealth-building in black communities.

What Is Commercial Real Estate (CRE)?

The higher cost of capital, rather than

real

estate fundamentals, is what is slowing down real estate investment. Of course, inflation and a recession could dampen demand for some property types; as discretionary spending decreases more people may stay home rather than spending money on retail and hotels. But overall, demographics and other demand generators are keeping occupancy up and rents high. Multifamily and industrial continue to be the two most desired property types.

The rapidly rising cost of owning a home is further fueling multifamily demand. The case shiller u. S. Home price index rose more than 20% year-over-year through april.

The rapidly rising cost of owning a home is further fueling multifamily demand. The case shiller u. S. Home price index rose more than 20% year-over-year through april.

Setting up a successful business in the city can be extremely challenging, especially today. As the old saying goes, real estate is all about “location, location, location” and most of the prime space for businesses are booked solid in the major metropolitan regions. That also means the costs of purchasing or leasing these commercial real estate properties are sky-high, even if you are forced to move out to suburbs many kilometres from where you need to be or if the property is not totally suitable to your operations. The solution? investigate setting up your operations in this thriving town in country new south wales.

Commercial (including retail) tenants and landlords

We advertise properties on behalf of commercial agents, chartered surveyors, owners, landlords and property professionals throughout the uk. Working with commercial letting agents, we discover and list all commercial property types and land including offices, retail, leisure, hospitality, industrial and warehousing. So whether you're looking for a small retail space in inverness, or prime grade a office space in central london, you can find it on rightmove.

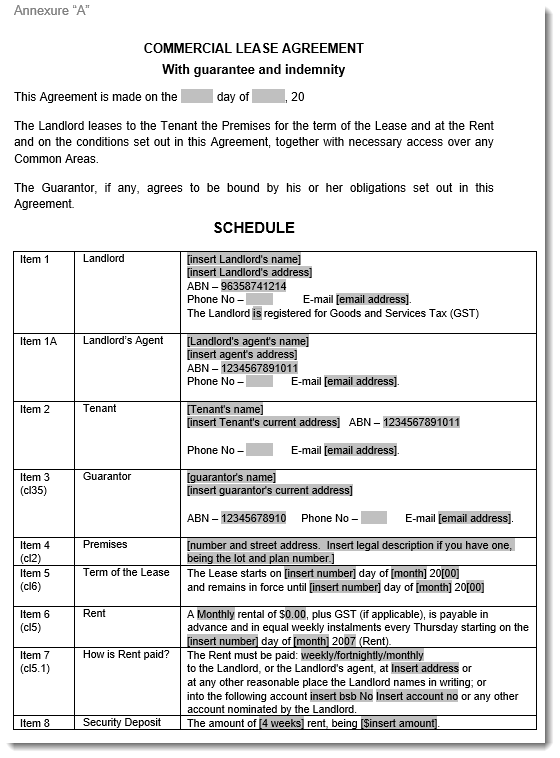

What is a commercial lease?

As a commercial property owner, if you choose to lease the premises to others you: must include the full amount of rent you earn in your income tax return can claim a deduction for your related expenses for the period your property is rented or available for rent can generally claim an immediate deduction for expenses relating to the management and maintenance of the property, including interest on loans. Other expenses are claimed over a number of years, including depreciation costs (such as the decline in value of depreciating assets – for example, carpet, furniture and appliances) and certain construction expenditure. You can't claim a deduction for expenses you incur for:.

Shop & retail property for lease warehouse, factory & industrial property for lease showrooms & large format retail property for lease development sites & land for lease hotel & leisure property for lease medical & consulting property for lease commercial farming & rural property for lease.